Tax Benefits of Real Estate Investing: A Complete 2025 Guide

Investing in real estate offers more than just rentals and appreciation—it’s also a smart tax strategy that savvy investors leverage to optimize both income and wealth-building potential. Here’s an in-depth look at the top tax benefits of real estate investing, fully updated for 2025 and packed with expert insights and data to help guide your strategy.

1. Deductions and Write-Offs: Offset Your Income

One of the most immediate perks of real estate investing is the ability to deduct a wide range of property-related expenses:

-

Property taxes, insurance, and mortgage interest

-

Maintenance, management fees, and repairs

-

Business-related costs—like advertising, legal fees, office supplies, and mileage

These deductions can significantly reduce taxable income. According to SmartAsset (2025), investors can qualify for substantial write-offs that boost returns.

2. Depreciation & Cost Segregation: Lock in Cash Flow

Depreciation allows you to write off a portion of the building (not the land) as it ages over time:

-

Residential property: depreciate over 27.5 years

-

Commercial property: depreciate over 39 years

But you don’t have to stay on that schedule. A cost segregation study breaks properties into components (e.g., fixtures or landscaping) to accelerate depreciation. Business Insider reports one investor saved $1.8 million in taxes through cost segregation—spending just $10,000 on the study. That’s a 5‑figure return just from tax strategy alone.

3. Bonus Depreciation & Section 179: Write Off Big, Fast

Thanks to the new tax legislation (the “One Big Beautiful Bill Act,” signed July 2025), investors can now:

-

Permanently claim 100% bonus depreciation on qualifying property placed in service after January 19, 2025

-

Use Section 179 to expense certain property upfront as well

These changes are major—allowing investors to deduct large chunks of costs immediately, increasing early-year cash flow and reducing long-term taxable income.

4. Pass-Through (QBI) Deduction: Keep 20% of Rental Income

Under the Tax Cuts and Jobs Act provisions, the Qualified Business Income (QBI) deduction allows eligible investors to deduct 20% of their net rental income through qualifying entities like LLCs or S-Corps. This deduction is now made permanent under the 2025 law.

5. Opportunity Zones: Defer and Potentially Eliminate Capital Gains Tax

If you reinvest capital gains into a Qualified Opportunity Fund (QOF), you get powerful tax incentives:

-

Defer capital gains tax on those gains

-

Possible step-ups in basis (10% after 5 years, eliminated for new investments)

-

Full tax-free appreciation if held over 10 years

The latest 2025 reforms make the Opportunity Zone benefits permanent, encouraging long-term investments in revitalization areas.

6. Favorable Capital Gains Treatment on Sale

When you sell a property held for over a year:

-

Long-term capital gains tax rates apply (0%, 15%, or 20%)—much lower than ordinary income rates

-

If used as a primary residence, you may exclude up to $250K (single) or $500K (married) in capital gains from tax, if eligibility rules are met

Strategic long-term investments combine depreciation, 1031 exchanges, and residence exclusions to maximize after-tax proceeds.

7. No Self-Employment Tax on Rental Income

Unlike active business income, rental income exempts you from self-employment taxes (e.g., FICA). That means more passive income stays in your pocket—no extra 15.3% split for Social Security and Medicare.

8. Real Estate Professional Status: Unlock Deeper Loss Deductions

If you qualify as a real estate professional (750+ hours/year devoted to real estate), your losses from depreciation and operations can offset other income, dramatically reducing your overall tax bill. This option requires careful recordkeeping but can be a game-changer.

2025 Tax Highlights: What's Changed This Year

-

100% bonus depreciation reinstated permanently for qualifying assets

-

Opportunity Zones unlocked permanently, with streamlined benefits

-

QBI (20% deduction) made permanent

-

Section 179 updates, and expanded expensing for commercial properties

-

SALT deduction cap raised to $40K for some (via 2025 tax law), easing expenses for high-tax area investors

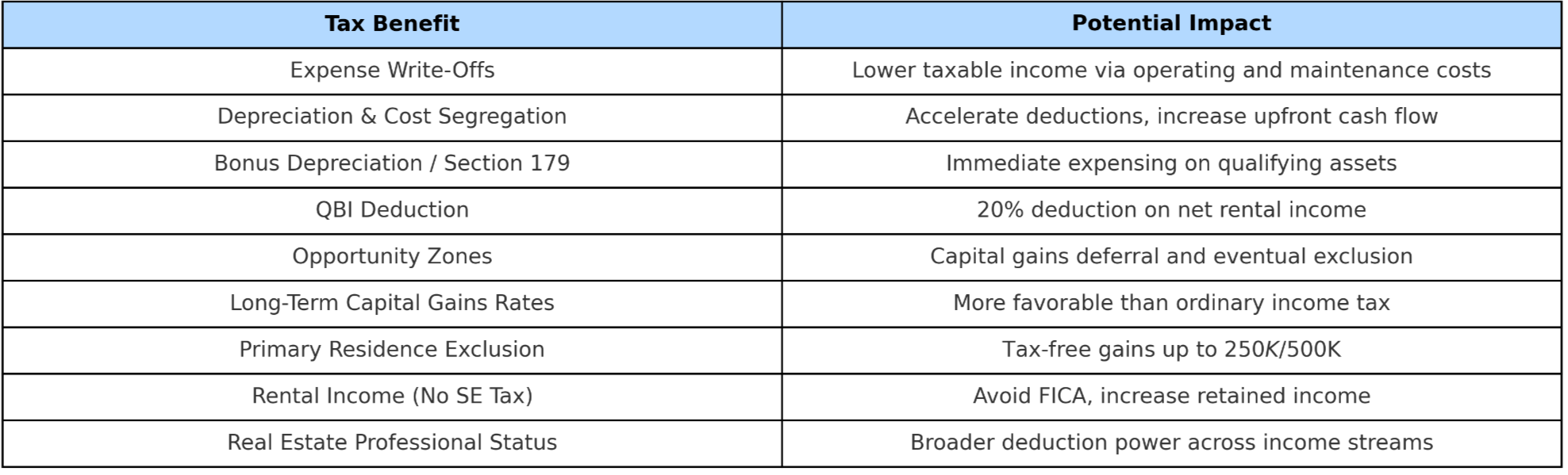

Essential Tax Benefits of Real Estate Investing in 2025

Here’s a quick snapshot of the key tax benefits of real estate investing and how each one can impact your bottom line.

Why This Matters

These tax strategies—now enhanced and made permanent by recent legislation—can significantly improve your investment returns, not just through property value growth, but through intentionally savvy tax planning. They create powerful leverage for maximizing cash flow, increasing reinvestment potential, and preserving long-term wealth.

Need Help? Let’s Talk Strategy Tailored to You

Every investment situation is unique, especially when tax laws change. Whether you're planning a rental, development, or Opportunity Zone project, I can help you model the impact and design a strategy that aligns with your financial goals in 2025 and beyond.

Contact me today for a personalized tax-smart real estate roadmap.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

Scott Greenspan

Broker Owner