Should I Sell My House or Rent It Out?

If you’re considering buying another home while holding onto your current one, deciding whether to sell or rent it out is a key crossroads. Each path offers distinct financial, emotional, and strategic outcomes—so let's unpack them carefully.

1. Cash in Hand vs. Recurring Income

Selling unlocks a lump-sum of equity—ideal if you need capital quickly (for a down payment, renovations, or other opportunities). Plus, thanks to the Section 121 capital gains exclusion, you can exclude up to $250K (single) or $500K (married) in profit, provided you’ve lived in the property for at least 2 of the past 5 years.

Renting turns your home into a steady income stream. National data shows that asking rents for single-family rentals have grown nearly 40% over the last five years, significantly outpacing household income growth (~23%). Plus, in a city like LA, detached rents climbed nearly 7.2% year-over-year in February 2025. So if your rental income comfortably covers your mortgage and expenses, you're building wealth in two ways: income + continued appreciation.

2. Market Conditions: Timing Matters

Selling in a seller’s market—especially in high-demand areas like Hermosa, Manhattan, or Palos Verdes—can net top-dollar quickly.

Renting may be attractive right now: although national rent growth has slowed (even dipping ~2.1% year-over-year for small units), rental markets like LA remain strong, buoyed by elevated housing costs pushing more residents toward renting. That said, caution—rental pricing varies macroeconomically and by property type.

3. Tax Strategies: Exclusions vs. Deductions

Sell: Capital gains exclusion provides huge tax relief, especially for long-term primary residences. Keep in mind the exclusion resets only every two years.

Rent: Rental ownership comes with powerful deductions—mortgage interest, property taxes, repairs, depreciation, management fees—often reducing taxable rental income. Combined with continued appreciation, this strategy is tax-efficient long-term.

4. Time & Hassle Factor

Sell: Clean exit—no more maintenance, tenant issues, or unexpected costs.

Rent: Landlording has its challenges: tenant screening, emergency repairs, turnover, and understanding obligations under rental laws and tenant protections. In 2025, around 85% of landlords raised rents due to rising operating costs—yet 17% report regulatory compliance as their top challenge. So unless you hire property management (at ~8–12% of rent), renting can be hands-on.

5. Flexibility & Long-Term Upside

Sell: Lets you cash out, simplify your life, and reinvest elsewhere—great for clarity and peace of mind.

Rent: Maintains optionality—holding onto a property in a strong market gives you future flexibility, rental income, and potential for resale or return. Plus, you stay exposed to any continued home price gains.

6. Emotional & Lifestyle Considerations

Selling often means letting go of memories and community ties. Renting preserves those connections—and gives the freedom to return—but shifts your relationship to your home into a landlord-tenant setup. That dynamic can be jarring—trading intimate familiarity for transactional distance.

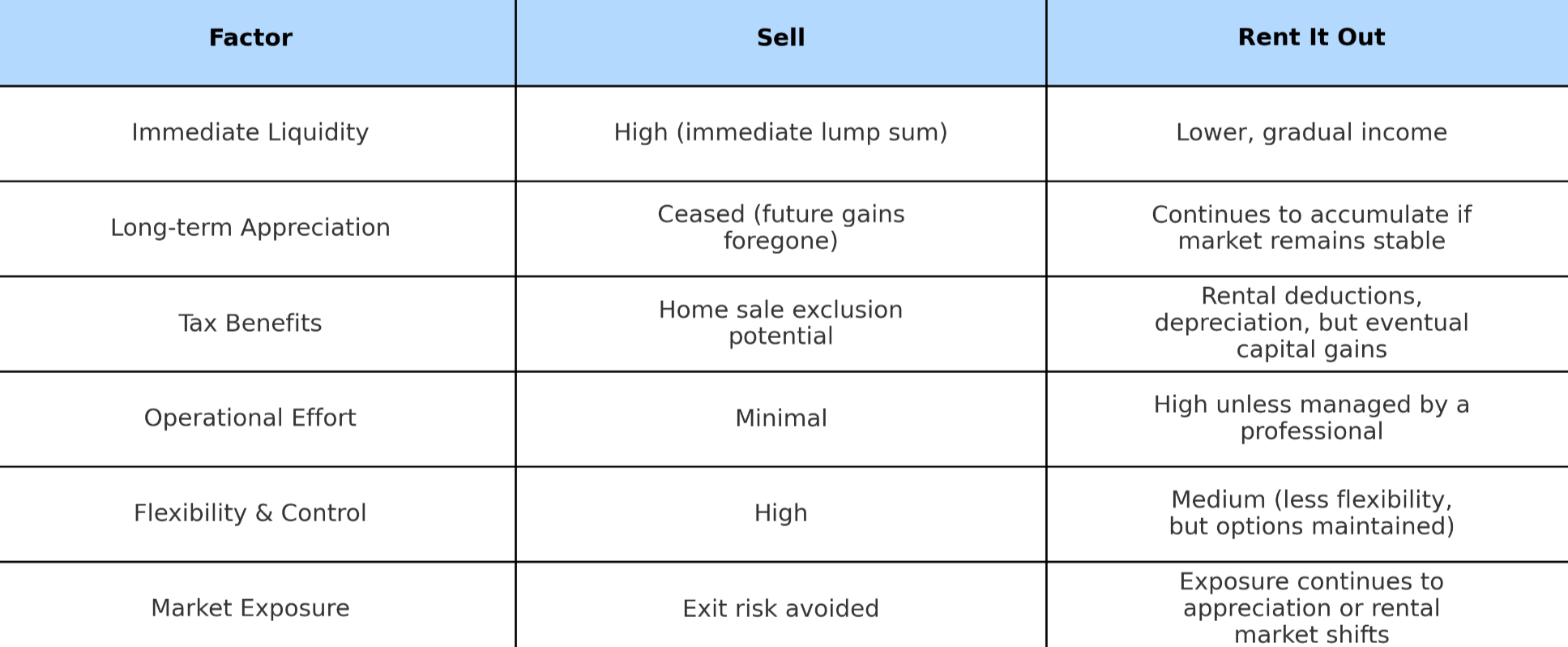

Selling Your Home vs. Renting: Side-by-Side Comparison

If you’re still weighing the question “should I sell my house or rent it out,” sometimes the clearest way to see the trade-offs is to compare them directly. Below is a quick breakdown of how each option stacks up across key factors like liquidity, tax benefits, and long-term market exposure. This snapshot makes it easier to decide which path aligns best with your financial goals and lifestyle priorities.

For homeowners with the financial flexibility to buy another home, the sell-or-rent choice hinges on your goals:

-

Sell, if you need liquidity, prefer simplicity, or want to fully turn over that piece of real estate.

-

Rent, if you want a long-term income stream, continued equity growth, and can manage—or outsource—the rental responsibilities.

Let me help you model the financials—rent roll vs. sale proceeds vs. taxes—so you can move forward with confidence.

Ready to dig deeper? Reach out for a customized analysis tailored to your neighborhood, mortgage, and goals.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

Scott Greenspan

Broker Owner