Should I Downsize My House to Save Money? Here’s What You Need to Know

I get it—downsizing isn’t just a financial decision. It’s deeply personal. You’re not just looking at square footage; you’re weighing freedom versus nostalgia, smiling at the idea of simplified routines, and wondering if this stage of life calls for something different.

Maybe you’ve thought, I’m paying more than I want in taxes and upkeep, or the big house is too quiet now that the kids are grown. Whatever brought you here, let’s walk through what matters most and whether now is the moment to make a change.

Why Downsizing Is on Your Mind (Beyond the Numbers)

I remember talking to a couple last summer, they lived in a 4-bedroom home in Redondo Beach, but their empty nest felt cavernous. They’d pay landscapers more than they saved on their combined gym membership and travel. They asked: Should we stay, or simplify?

There’s power in unlocking equity; maybe you use it to pay off debt, boost savings, or cover a family trip. According to StorageCafe, downsizing could add nearly $200,000 back into your pocket. That kind of difference can redefine your sense of ease.

Real Homeowner Benefits That Matter

Lower Monthly Bills

Replacing a larger mortgage, insurance, or property tax bill with a more manageable one can free up funds for what matters: family dinners, student tuition, or even a part-time hobby. Many smaller units in the South Bay come with lower utility and upkeep costs, and no lawns to mow.

Fewer Chores, More Life

A friend who moved into a 2-bed condo told me she now uses her weekends for paddleboarding, not power tools. With less to maintain, life slows down in a good way.

What About Interest Rates? Should You Move Now or Wait?

Here’s where you see real returns and where timing can be a difference-maker.

-

Mortgage Rates Are Trending Down

The average 30-year fixed rates are hovering around 6.5% today, down from the 7%+ highs earlier this year and as low as we've seen in months. In fact, Freddie Mac reports a drop from 7.04% in January to 6.50% in early September, with 15-year rates now around 5.60%. That half-percent drop is actually meaningful, potentially saving hundreds monthly. -

Experts Predict a Gradual Slide…or a Plateau

NAR expects rates averaging 6.7% through the end of 2025, with potential reductions to around 6% by 2026. While Fannie Mae forecasts similar numbers around 6.5% by late 2025.But, as Investopedia warns, waiting for interest rates alone might backfire, especially since there's no guarantee they'll drop significantly. And even if the Fed cuts its benchmark rate (which isn’t set in stone), mortgage rates may not fall in parallel.

-

What This Means for You

A lower-rate environment now means less competition; some buyers are holding off, expecting lower rates later. That opens an advantage for you: more inventory and more negotiating power.

Is Now the Time to Downsize?

Here’s how to see if the stars are aligned:

Pros of Now:

-

Historically lower rates mean less expense and stronger affordability.

-

Market movement towards a buyer’s edge as some people sit on the sidelines.

-

You can always refinance later if rates drop further.

Reasons to Hold Off:

-

If your current home value hasn't appreciated much lately, the returns might not be as strong.

-

Emotional readiness—packing up years of memories is tougher than it sounds.

-

If you haven’t saved enough for a strong down payment or emergency fund, a move may feel rushed.

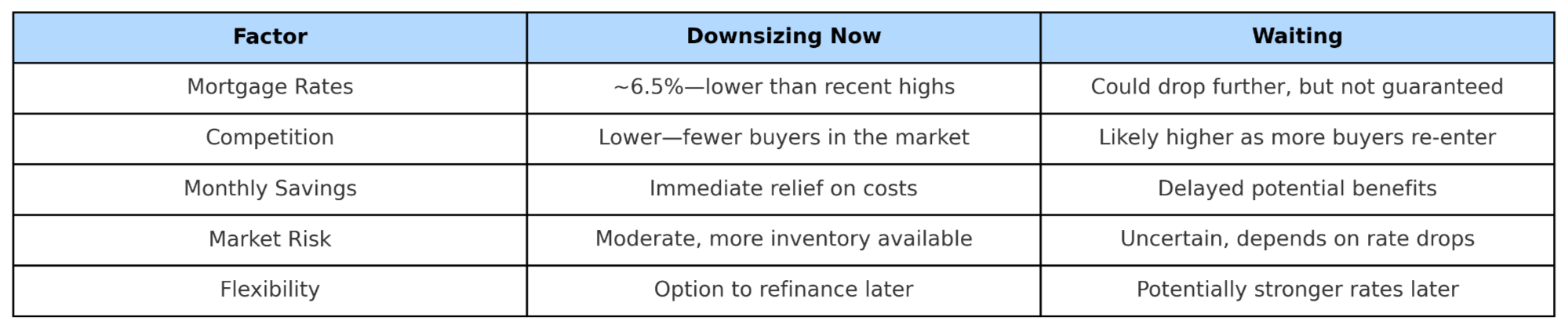

Downsizing Now vs. Waiting: What Today’s Market Means for Homeowners

If you're asking whether you should downsize your house to save money now or hold off, consider the key differences in rates, competition, and timing. Here’s a side-by-side look at how today’s conditions compare with waiting for the market to shift.

To see what this can look like in practice, let me share the story of a South Bay couple who downsized recently. The couple decided to downsize from a big home in Palos Verdes to a cute Redondo Beach cottage. They used half their equity to pay off student loans and built a mini fund for summer camps and travel. Their mortgage dropped by $1,000 a month—at the cost of stairs, but for them, that felt like freedom.

Your Action Plan

-

Run your numbers. Get Stated Pre-Approval for a smaller place—see how the math works for you.

-

Shop current listings. Walk the options so the idea of “less space” feels less abstract.

-

Talk to financial and real estate pros. Know the closing fees, tax implications, and how your equity can serve goals.

-

Decide on timing. If your house value is strong and you’re ready, the current market and rate environment may just reward that decision.

Downsizing Can Be Your Next Step Forward

If “should I downsize my house to save money?” has been keeping you up at night, this guide shows that it’s more than an economic move; it can be a shift toward financial clarity, flexibility, and even joy in your day-to-day life. Whether now or later, when the timing’s right for you, downsizing isn’t shrinking your life; it’s trimming distractions and expanding what matters most.

Whenever you're ready, I’d be happy to walk through your goals and help you make the choice that fits not just your budget, but your life.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

Scott Greenspan

Broker Owner